As society navigates a new digital landscape, encompassing multiple spheres of everyday life, minor tweaks to existing consumerism and social interaction dynamics have become increasingly necessary. For many, the digital migration has been a seamless shift from brick-and-mortar to online and mobile purchases. But what about the millions of Africans that are financially left out from participating in this digital space, and what type of financial innovation is required to make this space more inclusive to the whole?

Defining Financial Inclusion

To grasp the nuances of inclusion, it’s vital to understand the core definition and challenges of implementing it successfully. Financial inclusion, by definition, involves efforts made to make financial products and services accessible and affordable to everyone, regardless of personal net worth or company size. More than that, it aims to remove the barriers that exclude people from the financial sector and to subsequently improve their quality of life.

Global Perspective and mapping a blueprint

Globally, approximately 1.6 billion people are unbanked due to financial exclusion, of which roughly 11.8% are located in Africa. Some of the recurring reasons for the large number of unbanked individuals include:

- a lack of education;

- no valid identification;

- restriction of movement

- unaffordable financial products and services

- insufficient credit history

In a study done by EY mapping the potential revenue growth opportunity from improving financial inclusion, three of the most important technology drivers of inclusion were ‘high mobile adoption and e-payments’, ‘national digital ID schemes’ and ‘open digital data’.

So, where does the answer lie? In Fintech, which in essence is technology used to improve and automate the delivery of financial services, and is therefore key to financial inclusion in Africa.

Foundations for innovation

The direct correlation between the concept of accessibility and the exclusionary barriers to financial participation puts a particular responsibility on the private fintech and banking sectors to innovate with the support of state-controlled policy drivers.

Cashless payments, a pioneering concept in digital innovation, are not only pivotal to protecting the health and safety of consumers during the covid-19 pandemic, but also an instrumental cog in the longevity of economic growth and development in Africa. The foundation for financial inclusion through cashless payments in Sub-Saharan Africa has been laid by the growing 3G population coverage which was estimated to be 75% in 2018.

South Africa, a frontrunner in smartphone mobile penetration is expected to reach a penetration rate of 43% by 2023.

These statistics highlight the significance of mobile payment solutions as consumers gravitate toward more digital channels in a market where 15-20 million people are not regular users of banking and financial service institutions.

Embracing innovation and disruption

Financial inclusion, through innovation, should lie at the heart of new services in Africa, and beyond – which is why we’ve sculpted our product model on this inclusion as a guiding principle. We’re committed to simplifying payments for all of Africa by disrupting the payment gateway space with innovative digital payment solutions.

As a result, our online payment solutions place a particular focus on eradicating barriers to financial inclusion by offering products that enable real time payments on all smart web electronic devices. And, we encourage this kind of growth within the financial landscape. For example:

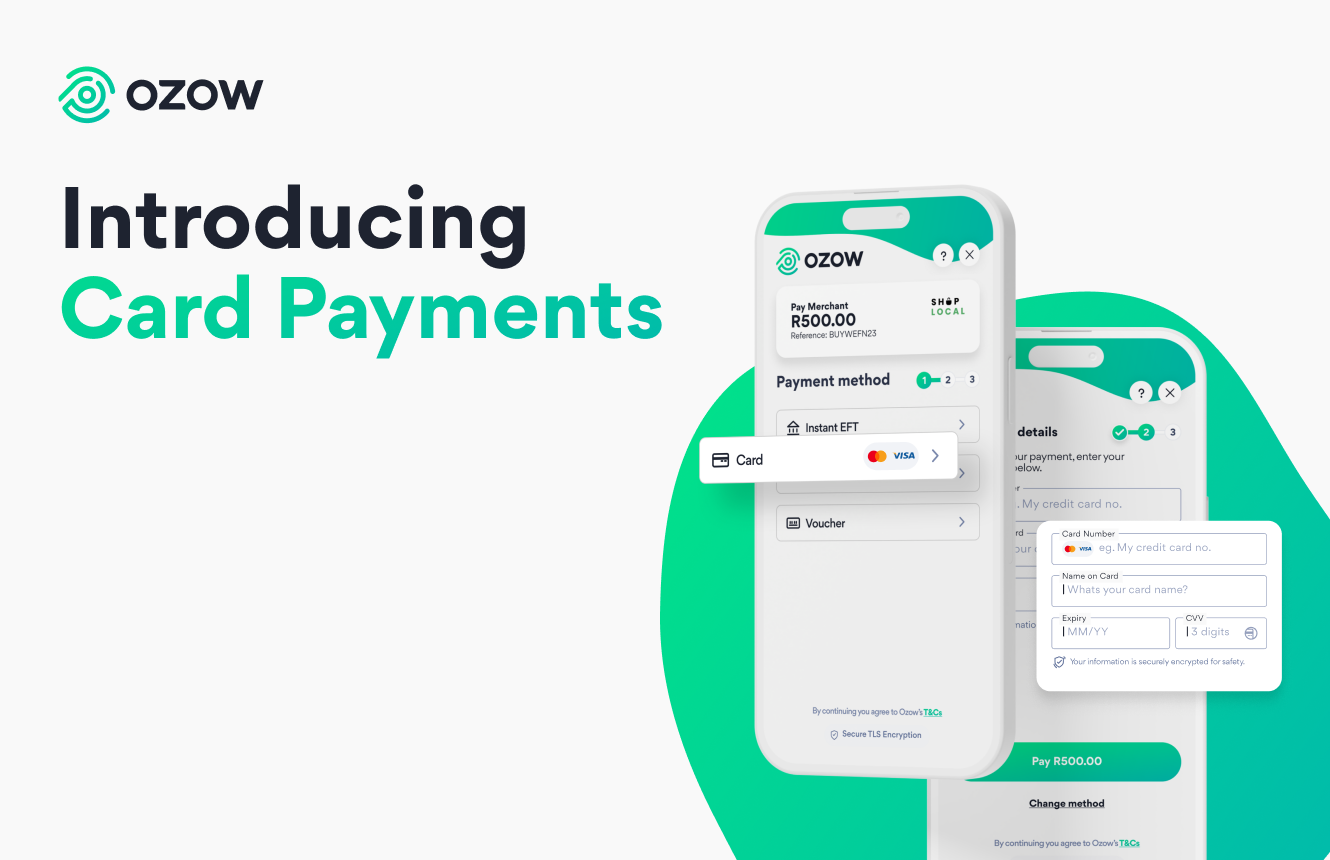

- Instant EFTs: Account payments through instant, online EFTs, payment request links via SMS, eBilling and QR codes on monthly statements are but a few of the innovative solutions merchants are able to offer consumers through Ozow’s product range. The focus on secure, customer centric solutions enables merchants to expand their market base and reach wider audiences while simultaneously reducing the cost of transacting.

- Mobile payment infrastructure: The ability for consumers to utilize mobile payment infrastructure is heavily dependent on the adoption of these solutions by merchants. Ozow has recognized the importance of wide-spread merchant adoption and developed affordable and easily integrated solutions for merchants of any size.

- Accessibility is a complex concept and extends further than simply providing the necessary tools for participating in the digital economy. Accommodating users of all six major banking institutions and simplifying the payment process by not requiring an app download are extended branches of the financial inclusion narrative that Ozow have set out to address. Ozow has answered the call for financial inclusion by developing customized offerings and using innovative channels to enable merchants to reach customers at a lower cost.

The Opportunity

With restriction of movement during this pandemic, accessibility to funds through online channels are now more important than ever. Driving financial inclusion requires the banking and Fintech industries to acknowledge that customers are becoming increasingly empowered to bank on their own terms regardless of time and location.

Financial inclusion is not only key to improving the quality of life for millions of Africans, but also holds billions of untapped revenue potential for banks and retailers alike to access. Want to know how you can be part of this inclusion? Find out more about Ozow.

Citations

-

Ozow Marketing

.png)