A major change is coming to South Africa’s banking and payments sector. Known as the Rapid Payment Programme (RPP), this evolutionary banking concept aims to create a simpler, safer instant payment ecosystem that would give people the ability to make real-time payments using simple identifiers, such as mobile numbers or email addresses.

RPP is set to change the course of how people transact in the future. Not only will this make it easier for people to be able to make payments, but it will also help solve one of the biggest challenges that our country faces – how to get the millions of underbanked South African’s transacting in the digital economy.

Led by BankServAfrica in collaboration with the Payments Association of South Africa (PASA), RPP is the first of its kind in the country – unifying the entire banking sector under the common goal of broadening and modernising the industry to include those who had historically relied on cash as their primary payment method.

RPP has been endorsed by various government bodies, 11 major banks and the broader fintech industry. We are fully supportive of this initiative, as it aligns perfectly with our mission to empower previously disadvantaged South Africans with the development of innovative payment solutions that meet their real-world needs.

What this will mean for you

What sets RPP apart is that you will be able to select phone numbers, email addresses, and domain-based aliases (e.g., user@bank) as a way to identify yourself when wanting to receive a payment from someone.

The system is also set up to enable you to be able to make or receive payments instantly without having to wait for the funds to clear, regardless of which bank you are with. This would also include the ability to easily request a payment from someone through a feature called ‘Request to Pay’.

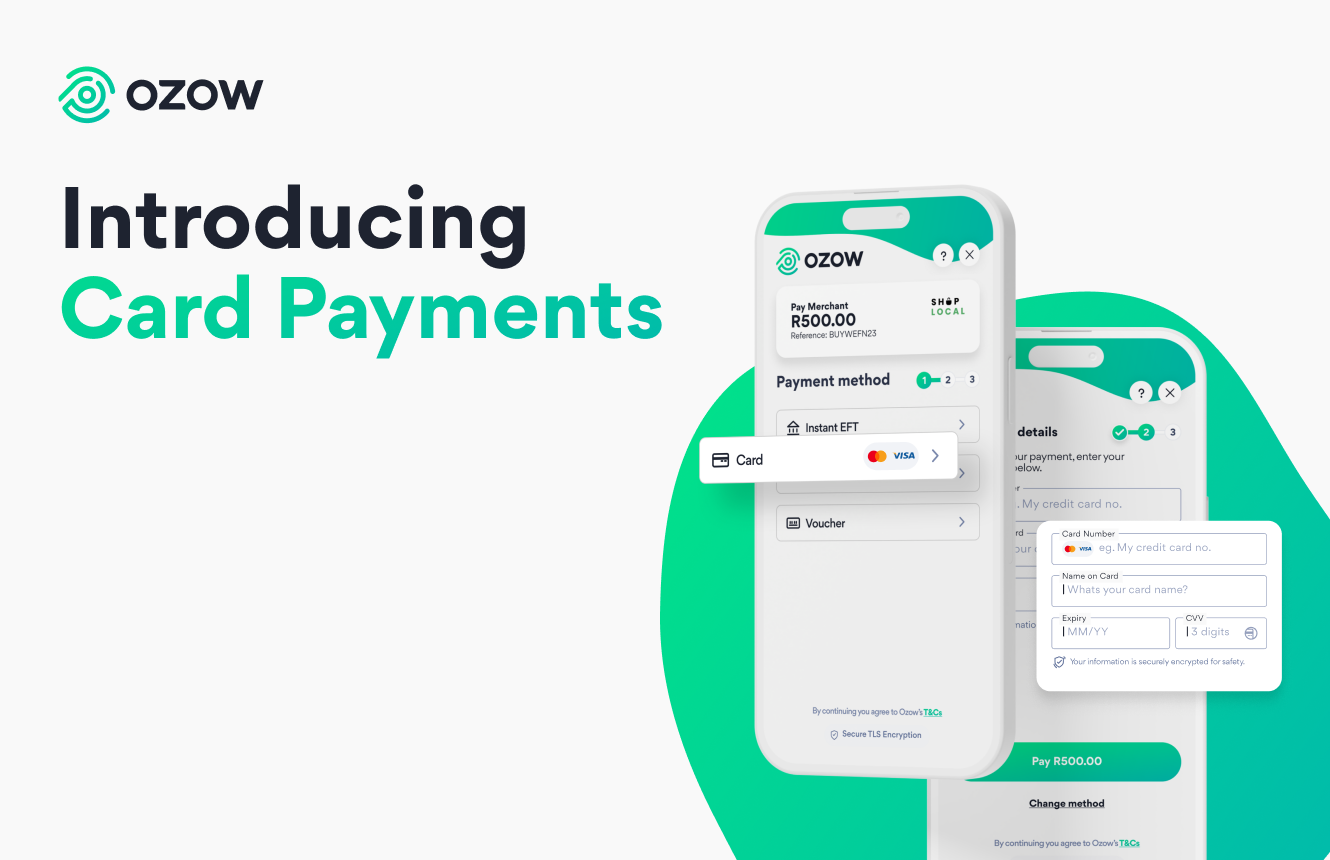

How you access the RPP system will be important. This is where fintechs like Ozow come in. Our role would be to develop the simple, mobile-friendly and easy-to-use payment solutions that allows you to make online, point-of-sale or peer-to-peer (P2P) payments using the RPP system.

With an expected launch in 2022, we are excited about what this will mean for South Africa’s payment ecosystem and how it will change the payments game for consumers.

Citations

-

Ozow Marketing

.png)